Inital Margin Minimmum Calculator

The margin requirements under EMIR require counterparties who are in scope to exchange margin on their over-the-counter (OTC) derivatives contracts that are not cleared through a central counterparty (CCP).

These requirements first took effect from 4 February 2017 under EMIR, subject to phase-ins that are based on firms’ categorisation and derivatives volumes. The implementation timetables below provides more detailed information on phase-ins.

To check projected margin requirements under the Portfolio Margin model, click the Try. Initial margin requirements calculated under US Regulation T rules.

We have produced a video that provides a more in-depth overview of the margin requirements under EMIR. It shows details on implementation timing and scope, along with advice on what firms need to do in order to meet the requirements.

Margin requirements

The Regulatory Technical Standards detailing the margin requirements under EMIR provide two types of margin that firms are required to exchange. The first is variation margin (VM), which covers current exposure and is calculated using a mark-to-market position.

The second is initial margin (IM), which covers potential future exposure for the expected time between the last VM exchange and the liquidation of positions on the default of a counterparty.

Counterparties subject to margin requirements

Financial counterparties and non-financial counterparties above the clearing threshold are covered by the margin requirements.

Under EMIR REFIT, the definition of FC has been expanded to capture EU Alternative Investment Funds (AIFs) established in the Union irrespective of the location of their Manager (AIFM). In addition, where relevant, the definition captures those AIFs (irrespective of location) with an authorised or registered AIFM.

There are, however, new carve-outs for UCITS and AIFs which are set up exclusively for the purpose of serving one or more employee share purchase plans.

Transactions subject to margin requirements

The margin requirements apply only to new transactions, they do not apply to existing deals. It applies to all OTC derivatives contracts that are not cleared through a central counterparty but with some exceptions:

- FX forwards and FX swaps (physically-settled) – VM only, no IM. For these contracts, VM only applies to those counterparties that are MiFID investment firms or credit institutions (this is based on recital 21 of EMIR REFIT and the draft published RTS which have not yet been approved by the European Commission)

- currency exchanges – VM only, no IM

- equity options – delayed implementation

- covered bond swaps – conditions need to be met – if so, only VM to covered bond entity

- one-way obligations (e.g. options) – one-way margin

- intragroup exemptions – conditions need to be met

Firm categorisation

A firm’s categorisation in relation to the ‘phase-in’ (see below) is important for 2 purposes. First, it is used to determine when the margin requirements apply and secondly, to determine if IM applies at all. The implementation timetable below has further details on the phase-in dates dependent on a firm’s categorisation (see also articles 36 and 37 of Commission Delegated Regulation 2016/2251).

To determine a firm’s categorisation, a firm should calculate its aggregate average notional amount on a group level (UK and non-UK) (see also article 39 of Commission Delegated Regulation 2016/2251). It must include all OTC derivative contracts that are not cleared (including FX forwards).

Timetable for implementation

Variation margin

| Date of Phase-in | Category |

|---|---|

| 4 February 2017 | Entities with group notional amount above EUR 3 trillion (entities with the largest portfolios on a group basis) |

| 1 March 2017 | All other entities (in scope) |

Initial margin

| Date of Phase-in | Category |

|---|---|

| 4 February 2017 | Entities with group notional amount above EUR 3 trillion (entities with the largest portfolios on a group basis) |

| September 2017 | Entities with group notional amount above EUR 2.25 trillion |

| September 2018 | Entities with group notional amount above EUR 1.5 trillion |

| September 2019 | Entities with group notional amount above EUR 0.75 trillion |

| September 2020 | Entities with group notional amount above EUR 8 billion |

Intragroup exemptions from the margin requirements

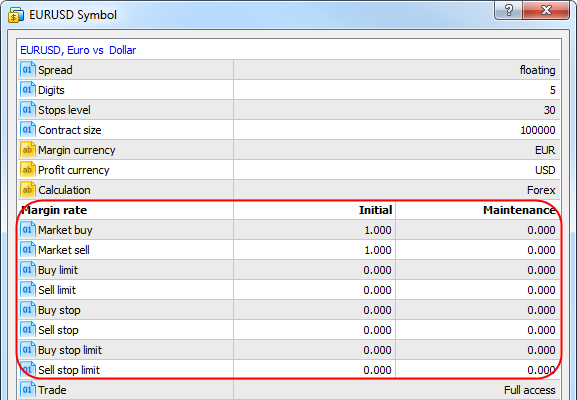

Initial Margin Percentage

Under EMIR there are exemptions from the margin requirements for intragroup transactions (provided certain conditions are met).

What Is Initial Margin

We have produced a video that provides more information on intragroup exemptions from margin and the application process firms are expected to follow in order to benefit from the exemption.

Comments are closed.